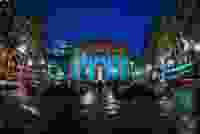

Mr Carney’s speech

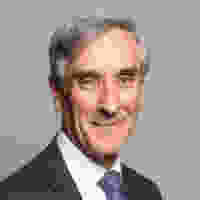

Regular contributor, John Redwood MP, analyses Mark Carney's recent speech and wonders why it is the Governor has failed to be open and comment on the tough policy being implemented and how it affects growth.

This week the outgoing Governor of the Bank of England gave a speech which was read as dovish and temporarily drove the pound down. He set out how despite low interest rates the Bank could if necessary ease money policy more. He did not encompass all of the ways in which the Bank could ease but was right about the possibility and the general magnitude of flexibility left in the system.

There were two glaring omissions from the speech. There was no detailed examination of the worldwide Central Bank moves to ease over the last few months, as practically every other Central Bank has joined the necessary move to stop the global slowdown and stimulate growth. China has lowered commercial bank capital requirements and brought forward local authority borrowing. The Fed has cut interest rates three times and pumped money in at the short end. The ECB has resumed Quantitative easing. Brazil, Turkey, Australia, New Zealand, India and many others have cut rates. The UK has done nothing and has ignored the slowdown.

The second is he did not refer to the substantial tightening the Bank has carried out. Contrary to the global trend the Bank has just doubled the countercyclical buffers restricting commercial bank lending. Its words and actions have until Mr Carney spoke this week helped boost the pound, in itself a monetary tightening.

I ask why the Governor did not comment openly on these moves and explain the different path the UK has taken. I think he should seek to justify the tough policy being followed and tell us how this affects growth. He should understand and explain the FPC and MPC interactions and the significance of balance sheet moves by both the Central bank and the commercial banks to money conditions and to economic growth. It looks as if the Bank has yet again misjudged the situation. He talks too much about alleged Brexit impacts and not enough about the global and domestic policy influences on price and output which are dominant as elsewhere in the world.

John Redwood is former Conservative MP for Wokingham and a former Secretary of State for Wales.