Budget 2021: The Government must get serious about business and the economy

In a defining moment for our post-Covid future, the Government must radically reset the UK economy and the business and enterprise environment with VAT cuts, the hypothecation of National Insurance to the NHS and an end to Corporation Tax, writes John Longworth, Chairman of the Independent Business Network.

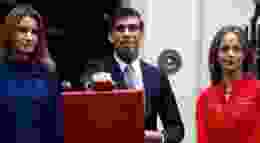

Shortly, Chancellor Sunak will present a mini budget which, along with the PM's roadmap out of lockdown, which will set out the medium for the country's long-term prospects. We cannot overstate how important this moment will be for the future of the UK. The next twelve months will likely define Britain's relative economic performance for decades – perhaps forever.

Since our exit from the European Union in January 2020, the political scene has been dominated by the Corona crisis and, thankfully, the termination of the transition period at the end of 2020 produced none of the turmoil predicted by ardent Remainers. Indeed, many are now embracing the project.

Although 'it's so far, so good' for the post-Brexit British economy and business, this impression hides the importance of the Government's next steps.

Notwithstanding the super performance of the vaccination development and rollout – notably, the former is delivered by the private sector, by business – it appears that the last year has been defined by public policy in a public sector catastrophe. Britain has hosted the largest drop in GDP since the beginning of the eighteenth century and, at the same time, the highest Covid death rate in Europe.

The Chancellor and No 10 must seize the once-in-a-lifetime opportunity that Brexit and the world's reemergence from the Covid pandemic provides, to radically reset the UK economy and the business and enterprise environment.

In our budget submission to the Chancellor, the Independent Business Network is recommending that family-owned and family-run businesses – the backbone of the British economy – are prioritised.

The IBN's budget submission sets out a profound reset of the tax and regulatory environment, in order to go for growth. This will itself generate tax revenues to pay for public services and, ultimately, pay down the massive debt pile. Anything else will lead to decades of lacklustre performance and austerity. For once, we need a budget for enterprise more than ever.

Rather than raising business taxes, the Chancellor should take bold steps to eliminate Corporation Tax by the next election. A cut in VAT by half for at least the next two years and a review to replace VAT should also be on his agenda. Business rates relief should continue, and a proper review of its future must be carried out as a matter of urgency.

Most significantly, the hypothecation of National Insurance (NI), as the sole and exclusive source of funding for the NHS, would allow proper transparency of value for money and a choice to fund the NHS either more or less. As NI is a flat-rate tax, it makes the most appropriate source of funding for a service which benefits all.

The immediate deregulation of GDPR rules, of the ergonomics directive and of the directive on seasonal and other agency work, would lift costs from business and promote post-Covid employment, including essential workers from overseas.

In their remit to deregulate, the Treasury must consider a major simplification of the tax code. It is long overdue and a major burden on business.

Chancellor Sunak must become the champion of growth, setting a new norm of 3% per annum (PA), in line with world averages. Anything else means accepting relative economic decline and a poor future for our people. Sunak must focus on deregulation, not just for the City, but also the vast majority of the business sector, to benefit the wider economy and to deliver the long-promised "levelling up" that is highly dependent on stimulating manufacturing and exports.

The Government needs to get serious about business and the economy, in the interests of Britain. There is no time to lose and no quarter for faint hearts. There must be an end to Whitehall and Treasury "declinism" once and for all.

Make no mistake, this is Boris Johnson's Churchill moment and Sunak's moment to prove himself. Only then will we see what they are truly made of.