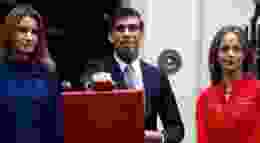

The Government is brazenly retreating from its hard-fought Red Wall

Topsy turvy policies on the economy and an unfathomable ability to throw away massive opportunities is leading this government and the country towards serious trouble ahead, writes John Longworth.

Boris Johnson recently described the economy as a bird which requires its two wings to be in balance, one wing being the private sector and the other the public sector. No doubt this is how the "statist" social partners, the TUC and the CBI view things but it does not chime with enterprise. As the private sector effectively pays for public services, a better analogy would be that the economy is the bird and the public sector the burden.

Unfortunately this preference for the state to be the answer has translated across government policy, including the endlessly referenced "levelling up". Far from the current levelling up agenda providing the regions with the ability to create wealth rather than relying on welfare, the bottomless spending spree of tax payers money is riddled with vanity projects and virtue signalling, which ignore productivity improvement and instead soak up valuable labour when there is a labour shortage. The result is further pressure on inflation. To use the biblical analogy, the regions need a fishing rod not a lot of fish, smelly fish at that.

Worse still, the overarching policy of profligacy is driving taxation towards a stifling figure of well over 40 per cent of GDP. We appear to have elected a socialist government which is in the thrall of some near communist institutions like the NHS and controlled by Whitehall mandarins. A techno-bureaucrat elite now directs every aspect of our lives and we have a government who sees the solution to be always interwoven with more government. The answer to levelling up is most definitely not that.

Given the fully anticipated and eye-watering levels of government spending it is utterly bizarre that the Treasury did not take the opportunity of ultra low interest rates to acquire very long dated, or perpetual, bonds and someone should be seriously asking the question as to why. These could even have been used to make headroom for tax cuts and other economic boosters.

In any event the Treasury's approach to taxation is utterly confused and contradictory. While income tax cuts mooted recently are to be welcomed why then put up national insurance?

The planned increase in corporation tax differentially penalises British businesses who pay it, while differentially advantaging foreign multi nationals, including clicks businesses, who avoid it. Meanwhile a proposed reduction in VAT removes tax from foreign "clicks" companies whereas a reduction, or at least a reform, of business rates would help British "bricks" businesses and particularly family owned and private operations. We still have a crazy regime whereby investment in plant and machinery, that is in productivity improvement, leads to increased tax. Is it any wonder that investment in manufacturing in the U.K. has underperformed competitor countries for most of the last century and beyond.

The whole Treasury policy is topsy turvy and working against the success of post-Brexit Britain. Perhaps this is the objective of the Treasury blob.

The inconsistent approach of government to the Omicron scare is another example of economically illiterate and damaging economic management. The overreaction to the more infectious but very likely less deadly variant destabilised the recovery but more specifically, the discouragement of Christmas parties has knocked back leisure, hospitality and retail at the very time of the year when they were able to generate significant sales and profit. Less a shot in the arm and more a shot in the foot for Britain. This is sheer madness – a lock down could knock 3 per cent off GDP and should be avoided at almost any cost.

Meanwhile the Government has done nothing to cut red tape and boost business and will be facing a sudden increase in customs and VAT administration on the 1st of January as new rules regarding the EU come into force. There has been no regulatory divergence from the EU. The opportunities of Brexit are not being seized. It is almost as though the blob is deliberately trying to keep the UK in a holding pattern, shadowing the EU in a form of proxy membership.

The one area where a bold policy suite has been applied is regarding Net Zero, but this has left the country dangerously exposed. Such an "ultra" approach as that taken by the Government is totally out of step with the majority of global GDP. The plan to achieve Net Zero has not adopted a smart approach to achieve the goal and simultaneously provide energy security, but instead will result in a sharp shock for consumers and tax payers, who will be required to subsidise uneconomic renewables and ensure unreliable supply. Such a shock will it be as to potentially wipe out the significant Conservative majority.

Across the board the failure to deliver by the Government will serve to disappoint "Red Wall" voters and it is only the absence of a viable alternative that mitigates this.