Now more than ever, financial literacy is vital for our children

As the UK looks set to battle the current cost of living crisis for some time, Christine Loredo writes that this should underline the importance of making sure our children have a solid grasp of financial management.

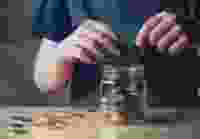

The COVID-19 pandemic shone a light on the financial preparedness of individuals and families, and what it revealed is that the average British financial situation is in a precarious state. A third of people have less than £600 in savings, and 41 per cent don't have enough savings to live for a month without income. Collectively, we are sleepwalking into a financial time bomb.

Our education system empowers students to leave school with knowledge of metaphors, algebra, and dates of historic battles – all very important life lessons. Yet far fewer graduates know how to save money, invest in the stock market, balance their budget, protect their money against inflation, or save for retirement.

If anything came out of COVID-19, it is that we need to start teaching financial literacy in schools so that we can prepare the next generation for financial uncertainty.

I'm of the generation where my parents encouraged me to study hard, get good grades, obtain a university degree, and secure a well-paying job. The reasoning was that by getting a good job at a great company people can cover a mortgage, living expenses, a car, retirement contributions, and healthcare needs. Then after years of hard work you can retire at a destination of your choice.

Inflation threatens to kill this dream. We've all seen the news, inflation in the UK is at a 30 year high, which is putting a significant squeeze on the cost of living. Furthermore, the remote-working revolution – which can be seen as an opportunity for those who are savvy and privileged enough to navigate this new world – can also be a threat, given that competition for jobs is now global. Companies don't have to move their entire operations to India, China, or Vietnam: Asia can now come to them.

The rampant credit culture also poses a threat to the future of our finances. Credit card debt rose to £56.5 billion in 2021. When leveraged correctly, credit cards can offer great value by delivering rewards like air miles, upgrades, and free gifts. We don't always use or manage credit cards effectively. Yet most don't use them to their advantage; 6.3 million people were in credit card debt in 2021.

Similarly, the gig economy has had an impact on businesses and individuals. It is altering the way people view their jobs and this new way of work has impacted the steady flow of income for many people.

Educating young people about money is more than teaching them how to budget and manage their cash; it also means diving into the ways money works: the role of credit, how to effectively use debt, how to invest, and what it takes to save for retirement.

The 'classic' advice that we just need to focus on small expenses, such as cancelling our Netflix subscriptions or stop having a daily latte from the local coffee shop, is not only short-sighted, it is also incorrect. The focus needs to be on teaching students how to make money work for them and seeing the opportunities in today's economy. One lesson is of course understanding the value of having a diverse portfolio – one that consists not only of diverse investments but also of diverse income streams, which is the reality of being financially stable today.

A student graduating high school or university today will have several careers open to them that were inconceivable twenty years ago. At the same time, a downside to many of the attractive and flexible jobs is that they don't offer a lot of financial stability, which means that they require ultra-savvy money skills to navigate.

Again, financial literacy education is lacking in the UK. The Financial Times reports that only eight per cent of young people say they learned most of their money skills in school, with 17 per cent claiming they are entirely self-taught. In fact, one Ipsos Mori report reveals that 90 per cent of people in England admitted to learning "nothing" or "not very much" at schools.

Indeed, the importance of financial education has finally begun to receive the recognition it deserves. The Financial Times Financial Literacy and Inclusion campaign has unveiled its strategic plan to boost the financial literacy of the population. Similarly, charities like MYBNK and the Money Charity exist to help Brits with their financial literacy. Yet charities are fundamentally being forced to do the work of schools; that should no longer be the case.

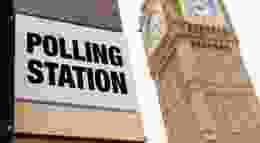

Momentum is building, however it's up to the tech industry, school administrations, parents, community members, and our politicians to ensure that these bills cross the finish line.

We finally have all of the components necessary to effectively bring the power of financial literacy to our youth. We have the technology, the know-how and the support of our communities. If we want to increase financial wellness in our future generations, it's critical that we pressure the government at both state and federal levels to pass these crucial bills, driving home the point that financial literacy is not a luxury, but a necessity.