Community banks: prioritise your customers or go extinct

Community banks are the beating hearts of towns across the States, but over the last few years, they’ve started to get complacent. They believe customers will remain loyal come rain or shine, but unfortunately, that’s no longer the case. The incoming US recession will push community banks to their limits, and I fear that without a customer retention strategy shakeup, they’ll be wiped off the map.

For too long, community banks have been hesitant to explore new customer retention strategies that bring them into the modern world. They're relying on in-person branches and paper promo flyers – techniques of the past that, nowadays, don’t encourage customers to stay.

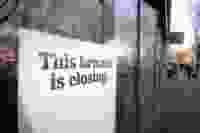

This is evident from the large number of US bank branches that have closed their doors. Since 2018, an average of 1,646 bank branches have shuttered each year – some even predict that the in-person branch will go extinct by 2041.

Customers’ banking behaviours are changing and increasingly moving online, so why aren’t community banks prioritising digital techniques, and AI in particular?

First things first, there is a critical lack of understanding. Many believe they cannot successfully embed AI and machine learning without staggering levels of investment. Leaders of small institutions see the £17 billion JP Morgan invested in technology last year and feel they could never follow in their footsteps.

Equally important is the fact that many banks don’t believe they have the technical know-how to onboard AI tools over the long term. In fact, less than 20% of community banks consider themselves experts in data analytics.

Of course, these are completely understandable, and I can see how they would hold smaller institutions back from pursuing AI and machine learning tools. Still, the reality is that there are alternative routes to embracing technology that don’t require vast amounts of capital or particular data science expertise.

The key to developing digital customer retention tools is to manage, analyse, and monetise customer data – and banks can partner with external expert firms to do so.

If they looked beyond the conventional narrative – the narrative that tells them sophisticated technologies are out of reach for small banks – they'd find they can implement AI in a way that works for them.

And the benefits would be immediately apparent.

With AI tools to analyse customer data and identify patterns in customer behaviour, banks can build comprehensive profiles that help them understand what a customer needs and when. Whether it’s extra support for a customer struggling to make their repayments or a new product for a customer with growing savings, these technologies can fill the in-person banking gap, which, let’s face it, is only set to widen.

Leaning on these technologies provides opportunities to strengthen customer relationships, upsell, and manage risk effectively – all through digital channels. In short, it reduces the all-important customer churn rate and helps banks thrive.

Of course, some smaller banks are already successfully implementing technology – yet they don’t want to publicise it. They don’t want to be viewed as industry ‘mavericks’, and honestly, that’s the real issue.

Fundamentally, many smaller institutions don’t want to buck the trend. They don’t want to step outside of their comfort zone and modernise to fit in with the changing world.

But frankly, they don’t have a choice – building customer relationships through digital channels is fast becoming a non-negotiable.

And implementing innovative retention strategies will be even more crucial if an economic downturn hits and the likelihood of bank runs ramps up. An average of 23 banks have failed each year since 2000, and that figure could rise should community banks remain stuck in their old ways in a recessionary environment.

Economic challenges and a wave of consolidation have steadily chipped away at the number of US community banks over the last few decades. We’re already losing valuable institutions, but if they refuse to embrace new retention strategies, I worry a full-blown US recession could wipe the remaining 4000 off the map. We could see an extinction-level event.

Adam Turmakhan is the CEO and COO of TurmaFinTech, a Florida-based fintech startup.