Budget 2017: axe the tax giveaways

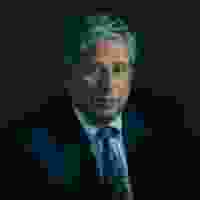

Parliament Street's Director of Financial Services, Tim Focas, explains why with little deficit wriggle room, the Chancellor needs to scrap his tax giveaways.

When the unusual coupling of David Cameron and Nick Clegg hooked up in the now distant memory of the rose garden back in 2010, it was done so with one central thing in mind, to wipe out Britain's largest budget deficit since the Second World War. Seven years on and Brexit negotiations aside, the deficit is still the governments biggest challenge.

While the deficit, the difference between tax receipts and how much is spent on public services, is down by a third, one can't help but think that more could be done. Chancellor Philip Hammond's first Budget next week will prove as much. And one policy in particular needs scrutiny – the £12 billion hole that has resulted from bringing over 3 million people out of paying income tax. Now before you get the wrong end of the stick, as a low tax Conservative it is great to see how much this has helped so many hardworking people. At the end of the day, the bulk of the working age population have found a little bit of extra money, roughly £500 a year, but the question is: with deficit reduction slower than expected, is it a policy that the country can really afford? The answer, judging by the fact that the national debt is closing in on 90 per cent of GDP, is no. In 2010 and 2015, the Tories sold the electorate on the importance of reducing the deficit. All well and good, but tax breaks such as raising the income tax threshold, goes against the hard line get spending down at all costs aspiration.

Clearly, borrowing more to implement a populist policy was more politically important at the time than considering what was best for economic credibility with the debt markets. However, with Philip Hammond already vowing not to touch a £27bn 'room for manoeuvre' war chest due to uncertainty around Brexit negotiations, an extra £12 billion shaved off the deficit ahead of his first budget would have been more than welcome.