British business has always been progressive, its tax should be as well

Rishi Sunak faces the challenge of protecting against recession whilst stimulating business. A fair, progressive tax system for businesses, just like we have for individuals, would do just that, writes Shaz Memon.

At present, the more an individual earns, the more he or she contributes. Why not apply the same principle to businesses, including a tax-free allowance for small and new businesses?

A progressive tax is the simple idea that the more you earn, the more you have to pay to the state. In the UK, the progressive income tax means that if you earn more than £50,720, you pay 20%, and if you earn more than £150,000, you pay 40% tax. For companies though, it is a uniform fixed rate of 19%, whether you've made a tenner or a billion; that isn't fair, and it disproportionately holds back small businesses. It also makes starting up a new business less attractive.

Progressive taxes make innate sense. The more money a business makes, the greater your obligation to preserve the society in which that profit was made. Most citizens agree that the progressive tax system is a fair and equitable way to tax our citizens; that's why most countries use it.

However, in many countries there is a two-tiered system; businesses pay a flat tax rate, whereas citizens are subject to the progressive, bracketed tax. It's time we started talking about progressive corporate tax for big businesses, especially because when you're running a small business, there often isn't that much of a difference between the company's profits and your personal income. In fact, they are often the same thing.

For big business, however, there is an army of accountants and lawyers minimising their tax. It's time to level the playing field, by making it more progressive, just like income tax.

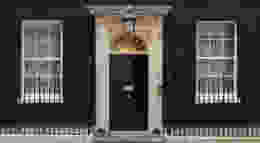

A policy like this would upset big business (which is probably why it is unlikely to ever happen). However, it would allow Sunak to raise public funds whilst stimulating business growth, which is exactly what he needs to do.

What he loses in big business support he will more than make up for in popularity: supporting small businesses, whilst ensuring that larger, multinational businesses pay their fair share would poll well. More importantly, it would work well.

2020 saw a record number of new businesses established; the pandemic's 'entrepreneurial dividend' should be harnessed. Between 2019 and 2020, there was an increase of 12.3% of new businesses started, which constitutes an extra 84,758 new small ventures. They will become even more important as the post-furlough unemployment cliff draws nearer for millions. A progressive corporate tax rate could give a large tax-free threshold to those small businesses, giving them the space to breathe, hire, grow, and support our economy.

On the other side of the scale are those large businesses, especially the multinational 'Big Tech' corporations, who don't seem to pay anywhere near their fair share. Amazon paid £293 million in tax, even though it made £13.73 billion in sales in 2019. This is stark contrast to the 19% corporation tax it is supposed to pay. It's time that we faced up to those companies who have turned a colossal profit over lockdown, but not contributed back into the society in which those profits were made.

My dental marketing business was able to keep all our staff employed through the pandemic, yet we still paid a higher percentage of our total earnings in tax than Amazon did. Through the power afforded by expensive lawyers and creative accountants, larger corporations inevitably end up paying less tax. And even if they do pay their fair share, that fair share is the same as the small family-owned business round the corner.

You do not need to be an economist or a lawyer to see that this is both uneconomical, and unfair.

If my business, for example, had had a tax break in its first three years, I would have been able to hire more staff earlier. This would have turbocharged my growth, and created a virtuous cycle of more growth, more jobs, and ultimately, more taxes.

We should be proud of the fact that the progressive tax is a great British export. The idea was first implemented by Prime Minister William Pitt the Younger in 1798 in order to finance the French Revolutionary War. Since then, the idea has been supported by great British thinkers like Jeremy Bentham, Adam Smith and even the staunchly anti-tax John Stuart Mill.

This is a British custom, much like cricket, that has been adopted by the world. We must now look to adopt it when it comes to businesses as well as individuals.