This week's budget is set to fail

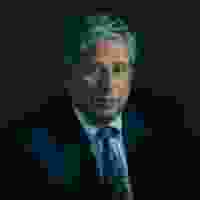

The Budget on March 6 may be Jeremy Hunt’s last major act of public service before he adopts a more obscure political role or is retired by the voters in his Surrey seat. He will then be able to concentrate on making money in business which he is rather good at.

In the meantime, he must present a budget for which he will be widely criticised whatever he does. The Labour opposition will be searching Roget’s Thesaurus to find new words for a what they will denounce as a historically unparalleled disaster and outrage.

Many on his own side will denounce the budget for failing to deliver tax cuts on a sufficient scale to turn round their electoral fortunes (or the economy), neutrals will despair that he has pandered to the populist economic illiterates on his own side, failed to address endlessly postponed but necessary tax reforms and failed to be honest about the need to raise taxes to pay for the collapse of local services, the gaping holes in the NHS, decaying infrastructure and underequipped armed forces. Wisely he is setting expectations at rock bottom.

Much of the informed commentariat is focussing on what the Office of Budget Responsibility will deem to be the ‘headroom’ for spending or tax cuts: what is left to dish out once the government has satisfied its fiscal rules (in particular, cutting government debt as a share of GDP four to five years ahead) after predicted government spending and receipts are accounted for. This arcane construct, built around the difference between two very large and uncertain numbers, would matter mainly to a gaggle of anoraks were it not for the experience of the Truss premiership which ignored it with disastrous consequences. We can be sure that Jeremy Hunt won’t be breaking any fiscal rules.

One of the reasons why the freedom of manoeuvre is so small is that the economy is stagnant and unlikely to see a surge of growth in the next few years bringing in more taxation. The dearth of business investment since Brexit has combined with the continuing failure to tackle Britain’s productivity problems to kill growth. Predicted spending is already unrealistically low, taking little account of the existing unmet demands on public services.

Now is also pay-back time for the massive spending incurred during the succession of crises over the last 15 years. The debt incurred is now having to be serviced at a time when interest rates are significantly higher. There are also some impenetrably complex fiscal consequences from the years of money creation through quantitative easing originally used to combat the negative effects of the financial crisis. The Treasury was required to pay the Bank of England for agreeing to purchase vast amounts of government debt. And that debt now must be sold to the markets alongside and in competition with other government borrowing.

The fundamental problem, which both the government and opposition will carefully avoid discussing, is that tax revenue is far too low for the government spending levels which the public expects. There is a legitimate debate to be had between libertarian, small-state Conservatives and social democrats but the consequences of either position are deemed to be too painful for the public to hear, let alone face. The unsatisfactory starting point for this discussion centres on the fact that the tax share of GDP is at a record post-war high and is therefore deemed to be ‘too high’. The OECD figures suggest that with 34-35 per cent of GDP in tax Britain is very close to the average.

There are European countries with much higher tax levels: Germany on 39 per cent; Italy on 43 per cent; France on 46 per cent; and the Scandinavians in the 40-45 per cent band. The poorer countries like Mexico and, also, the USA (28 per cent) are much lower. There are statistical issues with these comparisons over local v national taxes and various quasi-taxes. But the basic message is clear.

Liz Truss and Jacob Rees-Mogg can have Texan taxes if they are happy to ditch British universal services like the NHS. They should say so instead of indulging in ludicrous fantasies about sabotage by the ‘deep state’. Social democrats can have better, European, public services if they are willing to look at higher taxes on personal wealth, especially property, VAT and environmental taxes like fuel duty (currently frozen for motorists). But before an election, and probably after it, the Opposition will not dare to utter such dangerous thoughts. Much safer to stick with the Growth Fairy.

In the absence of a serious debate on tax and spend, Jeremy Hunt is looking around for a few token tax cuts for ‘working families’. Lifting thresholds is more fiscally progressive than cutting rates and NIC thresholds reach lower down the income scale than income tax cuts. Lifting thresholds would reduce the marginal rate of tax for low earners which is why the Lib Dems in the Coalition pushed for the policy.

How to pay for it? Jeremy Hunt seems to have in mind a few small money raisers like taxing vapes as well as cigarettes. But the interesting new idea is to pinch Labour’s policy of scrapping ‘non-dom’ status which enables this group of individuals to avoid tax on their global income. I recall arguing for that before and during the Coalition, but Osborne opted for a small tax instead. The difference is a few billion in revenue and Britain losing a few Greek ship owners and Indian billionaires.

For a Chancellor with limited freedom of manoeuvre, it is a no-brainer. But the revenue is peanuts compared with what must be raised to address seriously the bankruptcy of local government and the decay of the public realm.

Sir Vince Cable is a former Secretary of State for Business, and led the Liberal Democrats from 2017-19.