The cost of doing business crisis is just as serious as the cost of living crisis

The cost of living crisis is destabilising millions of families. But the cost of doing business crisis – where already fragile small businesses are saddled with increasing costs in utilities and labour post-pandemic – could destroy millions of livelihoods, writes Anthony Karibian.

The stress businesses are under is almost unprecedented, across utility prices, production and labour costs, and increased supply chain costs. Energy prices are soaring, along with raw material and production costs. Businesses are being hit just as severely as households, and until the Government acknowledges this, the problem will continue to grow.

Many would assume that this is a call for more bailouts (or, euphemistically, 'bounce back loans'). That isn't necessary. The best solution is for companies across sectors to freeze their prices, easing the burden on smaller companies and will help them to survive.

Some would argue that we should be helping individuals, not businesses. There is a modern tendency to tar all businesses with the wealth-infested brush of big, multi-billion pound companies.

We have forgotten that small and medium-sized enterprises (SMEs) represent 99.9 per cent of the business population in the UK, and many of these are struggling to stay afloat as they face a battle on numerous fronts. If those businesses go, so do millions of jobs, as well as the sense of community and belonging in high streets across the UK.

Some argue that the cost of living crisis lies at the heart of this, and that if we solve this, then the cost of doing business crisis will sort itself out. While these two crises are somewhat interdependent, this approach grossly underestimates the extent to which businesses are suffering.

The network of people that are impacted extends far beyond the owner, and even beyond their employees. SMEs contribute to our quality of life as consumers – take a hypothetical fish and chip shop, The Local Plaice, for example. This might usually be a hive of activity on Friday evenings, with locals gathering to catch-up and discuss the weekend's football fixtures. If this business goes bust, then not only do the owners and employees of The Local Plaice lose their jobs, but the town loses this weekly community hub. This is integral, particularly in rural areas where these kinds of regular meeting places are few and far between. Taking those spaces away from communities will have untold consequences for social lives, wellness, and mental health.

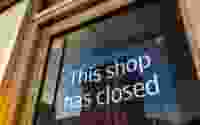

High streets are becoming deserted. Local, British-run SMEs are being replaced by big, impersonal chains that have no connection to the community – and often pay little UK tax. At least five per cent of respondents to a British Chambers of Commerce survey said that they are being forced to consider ceasing trading. If they do, the knock on effect on their customers and suppliers could mean 1 in 10 shut down. That should concern us all, just as much as families struggling to pay their gas bills.

The Government can try to brush this aside by pointing to recent statistics showing that city footfall has now almost returned to pre-pandemic levels. Although this is positive and businesses will welcome this development, the issue unfortunately revolves around far more than footfall.

Even if we saw a full resurgence in high-street shopping, the soaring business costs still need to be significantly reduced. Reidsteel's managing director, Simon Boyd, highlights how the cost of nickel, an essential material for his construction company, increased from $10,000 per tonne to an incredible $86,000 per tonne. To offset the disruption caused by the Ukrainian conflict, the British Chambers of Commerce is urging the Supply Chain Advisory Group and Industry Taskforce to work more closely with the industry to solve this issue. Alongside the unbearable cost rises that have come as a result of the cost of living crisis, fixed tariff contracts are coming to an end in a matter of months. This will greatly exacerbate the detrimental impact of energy bill increases.

This is why my firm, a provider of VoIP (Voice over Internet Protocol) to Britain's small business, has chosen to freeze its prices for the foreseeable future. If adopted by more companies, this would help contribute towards a solution. Currently nearly three in four businesses are putting prices up. With the rate of inflation in the twelve months to February 2022 being 6.2 per cent, a significant 0.7 per cent increase compared to January, price freezes will essentially act as price cuts. This should be a step taken by businesses themselves, as the government imposing price regulations is not the way forward – and neither is the Chancellor shaking more money from a money tree that does not exist.

Although the Government should not directly be providing more funds and financial contributions to businesses, other aspects of the British Chambers of Commerce's 5-Point Plan for dealing with the cost of doing business crisis provides helpful guidance. The Government must heed its recommendations to delay the National Insurance rise by one year and to provide small businesses with the protective energy price cap that households are receiving. Until they do that, businesses like ours should do the right thing.