Labour’s first budget will hurt growth with unprecedented tax rises

After weeks of fevered anticipation – and unprecedented pitch-rolling efforts by the government – Labour’s first budget in 15 years finally arrived. There is much to digest, but three fundamental points initially stand out to me.

The first is the audacity and sheer magnitude of the tax rises it contains.

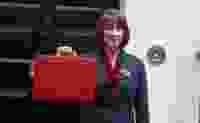

The PM and Chancellor repeatedly assured the country during the General Election campaign that they would not raise taxes on working people but, just seventeen short weeks later, Rachel Reeves has unveiled the largest tax raising budget seen outside a recession.

Her core argument since late July has been that she inherited a £22billion black hole but Richard Hughes the Director of the Office of Budget Responsibility (OBR) pointedly said following the budget that ‘nothing in our review was a legitimisation of that £22bn’.

The truth is the new Government were always intent on imposing massive tax rises - a £25 billion tax on working people by increasing National Insurance - alongside changes to capital gains and business taxes.

They have increased the overall tax burden by £40bn, so it now stands at the highest level in our country’s history - 38.2 per cent of GDP by 2028/29.

The reduction in employer NICs threshold from £9,100 to £5,000 is a huge increase in the cost of employing part-time and low paid staff, taking the rate on a salary of £4,100 from zero to 15%.

The independent Institute for Fiscal Studies (IFS) confirms that the largest percentage rise in labour costs is for employing lower wage workers. The sad truth is that Labour hid their intentions, but always planned to raise taxes and borrow without restraint.

Now we see that the scale and impact on the economy will be significant, and it will have a direct impact on the investment decisions of businesses of all sizes.

The second element that catches my eye is around the new government’s approach to investment in public services.

It is easy to assert a commitment to avoid ‘austerity’ but what the Chancellor did not do was place any conditionality on additional spending.

If the Government aimed to restore public sector productivity to just pre-pandemic levels, it would yield an additional £20 billion a year.

Welfare reform is another untapped source of savings; if out of work benefits alone returned to 2019 levels, the saving to the public purse would be in the region of £34 billion.

These options were not contemplated as the spending taps were turned on with no restraints.

Undoubtedly the Government will highlight the enormous nominal sums it will pump into the NHS, but in the immediate term this is likely to involve increases in agency staff as the NHS will not be able to spend these additional sums efficiently.

With no clear timetable for delivering reform it is highly unlikely, despite the best efforts of medical professionals, that productivity will improve.

My third and final point concerns the negative overall impact that this budget will have on economic growth in this country.

The incoming government inherited the fastest growing economy in the G7 with 0.7% growth recorded between January and March this year; inflation was at 2.0% in July as compared to 3.4% in 2010 and unemployment was 4.4%, almost half the 8% rate the Labour government left in 2010.

Yet despite this they have increased public sector net borrowing in every single year of the forecast – starting with borrowing £127 billion in 2024/25 – an increase of £40 billion from where Conservative spending plans stood in March.

The Office of Budget Responsibility has accordingly downgraded the growth forecasts for the next five years, with growth now 0.7% lower than anticipated before these budget measures were announced.

The increase in employers’ national insurance is bound to change the hiring behaviours of entrepreneurs and employers (in combination with the £5bn costs of the recent Employment Rights Bill).

It is inconceivable that these additional costs will not ultimately be passed on to employees. Increasing employers’ costs can only make it riskier for them to take on more people and more difficult to afford pay rises for their existing staff.

As an MP representing a rural constituency, I am keenly aware that the reforms to agricultural property relief and business property relief from April 2026 will have a profoundly negative impact on the food production capacity of our countryside, causing many family farm succession plans to be re-evaluated.

A massive hike in taxes and borrowing leading to lower growth is the disappointing headline of Labour’s first budget.

John Glen MP is the Conservative MP for Salisbury. He currently assumes the role of Shadow Paymaster General.