How to rescue Labour’s Green Prosperity Plan

A regrettable consequence of Labour’s repositioning as the party of Treasury orthodoxy is the side-lining of Ed Miliband’s £28 billion plan for ‘green investment’. The plan was cut, then postponed and is now a vague aspiration dependent on a wave of the wand from the Growth Fairy.

Maybe I can help? Having fought a guerrilla war in the Coalition government for ‘borrowing to invest’, I vividly recall the battles with the Treasury over the establishment of the Green Investment Bank. The Green Investment Bank was to be a vehicle for ‘green investment’ in a manner and on a scale as ambitious as what Labour seems to have in mind. I guess that the main reason why Labour doesn’t refer to it is that in the sterile tribalism of British politics anything positive about the Coalition has had to be obliterated from the historical record.

In fact, the Green Investment Bank (GIB) had a strong following wind with genuine cross-party support. The original vision was a British version of the German KFW: a free-standing but state-owned development bank but, in this case, with a ‘green’ mission. The GIB would be free to borrow on the strength of its balance sheet and its (government) equity capital.

We soon ran into trouble when Chris Huhne – the Energy Secretary – and I met the Treasury. They sent out an up-and-coming junior minister whose job was to recite the word ‘no’. Any publicly owned institution which borrowed would add to the government’s borrowing requirement. Given (then as now) the precariousness of the government’s fiscal deficit and debt position, the bond market vigilantes would quickly spot any off-balance sheet government borrowing. Sorry, but ‘no’.

We tried the usual arguments. Borrowing to invest is not the same as borrowing for day-to-day spending. Surely, a well-run development bank would produce returns on its investment? If the thrifty, financially conservative Germans can find a way of separating the KFW from government, why can’t we? Sorry, statistical conventions. Borrowing is borrowing is borrowing. And so on (with, now, the killer argument that Liz Truss is living proof that defying financial orthodoxy is fatal).

I confess to having caved in and accepted the Treasury offer of £2 bn. cash to set up the Bank, albeit within Treasury borrowing limits. We then spent a year or more setting up the Bank and hiring experienced city project financiers who could also work to a double bottom line: financial viability and environmental sustainability. And were willing to relocate from London to the purgatory of Edinburgh.

Amazingly, the Bank was a success. The GIB leveraged the £2 bn. to create a £12 bn. portfolio of green projects ranging from refinancing big North Sea offshore wind farms to waste-to energy projects and to refitting Glasgow’s street lighting with long-life bulbs.

After 2015, the Tories set about erasing the Lib Dem legacy from the Coalition. The British Business Bank and the Catapults survived, thanks to a guardian angel in the Treasury, but the Industrial Strategy (temporarily) and the GIB were to go.

The GIB was sold to McQuarrie, the Australian infrastructure bank, the argument being that any environmental projects worth backing could be financed by the private sector. McQuarrie turned the GIB into a Green Investment Group within their global asset management business. The British government retained a ‘special share’, designed to keep the original ‘green’ mission, and the investment team remained in Edinburgh.

The GIB (now the GIG) has been turned into a £26bn global fund. Alongside exotic investments, like the Mongolian Green Finance Corporation, there are 20+ projects in Scotland – at a cost of £625mn. – and others in the English North Sea.

So, my question to Mr. Miliband is: why reinvent the wheel? There is already an organisation in operation which could be a vehicle for the Green Prosperity Plan, run by clever project finance people who have probably already run a slide rule over most interesting green projects in the UK. The question then is how to get the GIB/GIG back to its original role in the UK and serving a bigger, wider purpose than further enriching McQuarrie shareholders.

My first, simple suggestion is to start conversations with the Bank on how to achieve this and at what cost. Hiving off the British bit of GIG to be run (again) as a UK government owned GIB? Or a joint venture? Labour presumably has access to smart people in the city who can look at the options and do the sums. McQuarrie has some incentive to be cooperative since its reputation in the UK as the predatory former owner of Thames Water is currently only marginally better than Fujitsu.

If a satisfactory deal is agreed, the reborn entity might need a fresh injection of a billion or two of Treasury cash to leverage more private investment, but not remotely as much as the £28 billion which has caused such alarm.

My second suggestion relates to how to find more, good environmental projects. A new government should take a fresh look at the government Green Book for the evaluation of projects in the light of the report of Lord Stern on climate change. It is just as relevant as it was when presented to Gordon Brown 15 years ago.

Stern makes a powerful case that climate related projects should not apply a discount rate which diminishes the value of long-term benefits. One of the worst decisions of the Conservative government was to reject the Swansea lagoon project because its long-term benefits could not be considered. The methodology should be reformed, and the project reconsidered. Private capital, reinforced by pump-priming government money (perhaps via the reconstituted GIB) and guarantees would get such projects launched. It would also be a better way of helping South Wales than subsidising ancient blast furnaces.

My suggestions are modest. But they provide a better option than running away when the media, inevitably, ask: how will you pay for the Green Prosperity Plan?

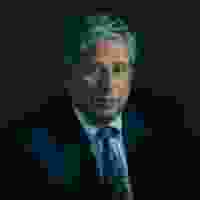

Sir Vince Cable is a former Secretary of State for Business, and led the Liberal Democrats from 2017-19.