Fund British jobs not Frankfurt fat-cats

Britain's financial services industry should benefit from the £39 billion Brexit dividend, argues Joel Casemont from Get Britain Out.

For many, the main advantage of leaving the EU without a deal and immediately going onto World Trade Organization (WTO) Rules is the ability to reinvest £39 billion into our economy. This will allow the United Kingdom to expand our most crucial and prosperous sector. We must be ambitious with our finance sector, open ourselves further to global financial markets and we must press our advantage in financial services in Europe and around the world. By investing the 'Brexit Dividend' in financial services, we will make the most of a WTO Brexit scenario.

May's betrayal deal, which was comprehensively defeated on the 15th January last week – by an historic margin of votes – exemplified its failings and has moved us closer to a WTO Brexit. Whether it's a deal or 'No Deal', it would not affect financial services in the same way as it would conventional trading. Financial services do not, according to an industry expert, Barnabus Reynolds, require a trade deal, nor are they subject to tariffs and national borders.

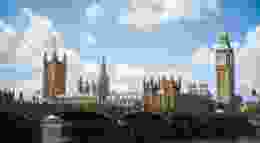

EU regulations, which limit innovation and development for many British goods, and makes British products less profitable due to compliance legislation, do not apply to Financial services. It would be good to invest at least part of the £39 billion in this sector, as it would allow Britain to maintain its advantages over the EU Member States. We are currently the main player in European financial markets – a fact which hugely angers the EU. No other European nation has the capacity or the capability of the City of London or Canary Wharf. The UK's financial sector is nearly three times larger than of both France and Germany. We must expand on this advantage with a proportion of the funds which will be available from the £39 billion 'Brexit Dividend'.

Our leading role in Europe's financial markets will only increase after Brexit. It will not decrease as 'Project Fear' would have us believe. There is no "regulation" to be met regarding financial services. This is called "Equivalency" and this is far easier to equate than the legislation and regulation which governs conventional goods. Most of this preparation has been underway since the United Kingdom declared to Leave the European Union on the 23rd June 2016. We would not be dealing with Brussels' Eurocrats beset on destroying Brexit. We would be talking with those who would have economic gain, not political gain, at their core. It is in their interest, as it is in ours, for Britain to succeed. They know, as we know: when Britain succeeds, they succeed.

The UK is already in advanced talks about how these issues can be resolved. The reason we haven't heard about this concerning such an essential sector is because the issues are being resolved as they arise by financial experts. We have a masterful tactic of 'Unilateral Equivalence'. This would allow for Britain to insist 'any binding contract remains valid after Brexit, because we will honour it'.

The EU tried to declare this illegal, but this has been formally dismissed by financial and legal experts as the EU seeking to manipulate the rules and set up a false market for themselves.

The EU needs British financial services more than any other sector. There is no EU equivalent which could substitute for the UK. A WTO Brexit would allow us to use financial services as a far more important card of political leverage in order to secure the most beneficial trade relationship with the EU under WTO. The Bank of England – a strong-held bastion of 'Project Fear' – admitted in December, the EU was at risk of losing £45 trillion worth of swaps positions which are held by EU banks. London dominates the European market for swaps and futures clearing, handling the bulk of the £580 trillion. Under a WTO Brexit, the EU clearly stands to risk losing this significant part of their financial services.

It is perplexing how we do not regard our financial services sector with the same degree of pride as our NHS. Britain is a world leader and a pioneer in financial services. In 2018 Forbes, the global media company, focusing on business, investing, technology, entrepreneurship, leadership and lifestyle, listed the UK as the best location in the world for new jobs. Britain saw a record £1.3 trillion of foreign direct investment enter the UK in 2018. We are the best place in the world for services according to Jones Lang LaSalle Incorporated (JLL) the American professional services and investment management company specializing in real estate, London was ranked as the best in the world for Tech investment in 2018. We have heard how Brexit will benefit our NHS, and we must ensure we invest in the Great British bastion of financial services.

Therefore, it is beyond reasonable doubt, Britain should use at least part of the £39 billion 'Brexit Dividend' to bolster our greatest asset, our financial services sector. We would continue to be the industry leader of Europe. We could increase our capacity to accommodate the growing economies of Brazil, India and Nigeria. When we Get Britain Out of the EU, financial services will not just help to make us a Global Britain, but a true Global Leader.