Tools to fight the EU’s aggression

John Redwood explores tools the UK could use to respond to efforts by the European Union to upset our departure.

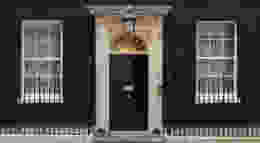

In his Delphic interview in Germany the Chancellor implied that if the rest of the EU does make try to make life difficult for the UK the UK has plenty of options in response. He did not spell out the detail, but the UK could cut taxes more to make itself a more attractive destination for investment. It could match anything the USA decides to do to switch taxation in ways which promote investment and manufacturing at home and for exports, and penalise imports. Financial regulation could be altered to make the City the most flexible value for money major market, whilst ensuring proper standards and disclosures.

I do not think we need worry. If we have no deal with the EU and operate under the most favoured nation status at the WTO it will be fine. I still think faced with the reality of high tariffs on agricultural products and a 10 per cent tariff on cars which will do them more damage than us they are unlikely to want this. We carry on a good and faster growing trade with the rest of the world than with the EU. That is largely conducted under most favoured nation status with modest tariffs under WTO rules.

The question for the Chancellor is rather, if there are tax changes and regulatory alterations which would boost UK jobs and incomes, shouldn't we be contemplating those anyway, whether the rest of the EU tries to be nice or nasty to us? There are voices in the City now saying we should aim for the "Financial Centre" model, where we organise a strong but business friendly framework to maximise the attractiveness of London to legal business. It is interesting to see even City UK, a past cheer leader for EU engagement, is no longer demanding we keep the passports. It reminds me that the City made passionate interventions to try to get us to join the Euro, saying the City would be damaged if we did not. They soon discovered the opposite was true. The City grew faster outside the Euro.

Ireland has fought long and hard to maintain a tax advantage over the rest of the EU. Luxembourg does well in investment management along with Dublin out of low taxes. The Chancellor needs to review tax rates with the intent to charge the rate that maximises revenue by attracting more business. This will usually be a lower rate than the one currently charged.

John Redwood is a former Conservative MP for Wokingham and a former Secretary of State for Wales. For more on UK tech and innovation policy, read Sean Kohli on why Britain must back its founders to win the AI race.