Have we sacrificed the free market to save the economy?

While the bottom line may be that Government intervention will successfully address the Coronavirus and the economy will recover, the impact of distorting the markets will be felt for years to come, argues Bill Blain

Financial markets are beginning to depress me.

I've spent 35 years working in capital markets, trading rooms and finance. I once blithely believed free and liberal financial markets and the invisible hand had the power to change the world through efficient allocation of capital.

Now?

I fear markets have become so distorted they are evolving into something parasitical – feasting on central bank and government largesse as they suck the lifeblood from economies while fuelling rising inequality across the globe.

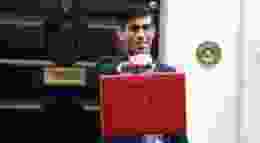

Today I have few expectations markets will play any significant role in solving the Coronavirus crisis. It's Governments that are going to drive solutions and recovery, saving us all… not private enterprise and markets. (And that will infuriate any conservative, mainly because they will know it's true…)

Whether it is the financially conservative Germans cutting VAT and granting hand-outs to families, the US looking at a massive infrastructure programme, or even the UK finally getting serious about the Brexit negotiations – it's going to be government actions that determine how quickly the global economy comes out of the looming recession.

Five months ago I wrote the coming crisis would not be about the virus, but all about the economic destruction it was likely to create. The reality is massively increased unemployment, corporates looking to cut costs, broken supply chains, and sovereigns under increasing debt pressure.

How the Government's virus narrative develops will set the pace towards recovery – how quickly business sectors can reopen, how soon hospitality and tourism can resume, and how speedily we can get back to worrying about the normal state of the economy.

While the economy has bounced off the bottom of the Covid-19 shock, can we really say we are now seeing a recovery? Not yet.

If anything, recovery is the wrong word. But after three months of lockdown, consumers are out in force, industrial production is rising, and economic activity is increasing. Overall, the signs are promising, and there is clearly pent up demand underlying economies, and it feels like the first glimmers of spring have arrived.

The area where governments excelled themselves was the shift application of brute strength and unlimited financial support via bailouts, furlough schemes and Central Bank action. It worked. The economic damage to the global economy would have been catastrophic if they had not acted. So far, this recovery has been fuelled by government action, and markets have just played along.

However, all that state largesse has a cost, and the result is chronically distorted markets. The jump in government borrowing raises a serious risk of consequences – in terms of confidence, ratings, and inflation, which generate further threats of unforeseen consequences. While the bottom line may be that the economy will successfully address the Coronavirus and will recover, the impact of distorting the markets will be felt for years to come.