Bricks versus Clicks

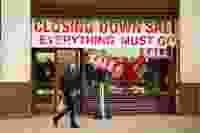

Over the years we have seen a demise in the demand for high street shopping and a seismic shift to online retail; the coronavirus pandemic has exacerbated this even further. With the current business rates and corporation tax in place family-run businesses are being destroyed. Change is needed immediately, writes Brendan Chilton.

Before the pandemic, High Streets were on life support. Online shopping and retail giants such as amazon and e-bay had transformed the way in which consumers purchase goods. Now, as a result of restrictions imposed on businesses due to Covid19, the British High Street is in essence dead. If we are to replace what is lost, a radical and innovative policy initiatives are going to need to be employed.

We know that this year Amazon has recorded extraordinary growth and is said to be worth $1.14 trillion. Jeff Bezos became $6.4billion richer this year as people were forced to shop online. Ebay has recorded record sales this year too because of the Coronavirus. Meanwhile, small family run and family owned businesses are going to the wall, and the national debt is piling up as government seeks to keep people from dropping into poverty.

As we look to our recovery, if we are to see retail, hospitality and other businesses return to our High Streets, we are going to need to create as level a playing field as possible between online and high street shopping. Online retailers do not pay business rates, while units in high streets do. The introduction of a levy for the online sale of physical goods is estimated to raise around £1.5billion a year, and would create a dynamic in which fair competition between traditional and online retailers would exist. The money raised could be used to reduce the cost of Business rates to support our High Streets.

When Jeremy Corbyn was Leader of the Labour Party, this policy was considered as part of a broad range of measures to ensure multinationals pay their fair share of taxation. Covid19 has completely transformed the British economy. If we are to do all we can to prevent mass unemployment and resurrect our High Streets, we need to ask multinationals to pay a little more to support small business. An online levy for purchased goods would be a positive start to such a process and would be supported by much family run and family owned businesses. Sir Keir Starmer should adopt such a policy and demonstrate his support for entrepreneurs here in the UK.

This measure alone will not solve the problems facing family owned and family run businesses. Other measures will also be necessary. Government should pass legislation freezing town centre parking charges for at least the next two years, to encourage consumers to come into town centers. Local government has become too dependent on parking income as a base budget source. It is essentially indirect taxation, which damages high streets and has a negative impact on business.

We also need a fundamental review of business rates. Even prior to Covid19, business owners in high streets would explain how business rates were crippling their ability to stay afloat. The current system is out of date and even the Treasury Select Committee in 2019 described the system as being "broken." Since 1990, rates have risen faster than inflation generating £31 billion for the Treasury last year. This is £31 billion that could be spent by business on employing workers, improving services and products. This must be reviewed as a matter of priority to assist the economic recovery from Covid19.

Government should not increase taxation on family run and family owned businesses in the immediate future. Such measures would cripple any economic recovery and almost certainly drive up unemployment which will ultimately cost more in welfare payments. The government should commit to freeze corporation tax to support business recovery for at least two years. Labour should also enthusiastically support this to demonstrate its commitment to creating jobs, growing the economy and standing up for small business. We cannot stiffen business through excessive taxation at such a critical moment.

The freeze in town center parking charges, combined with a review of business rates and maintaining or reducing corporation tax will be of great help to struggling businesses and will support the revitalization of our high streets. These measures, combined with the introduction of an online purchase levy will introduce a level playing field and family run and owned firms will be able to compete, fairly with larger firms. The British people want to see their economy recover and they believe strongly in fairness. These measures would satisfy both desires and set Britain on the path to prosperity.