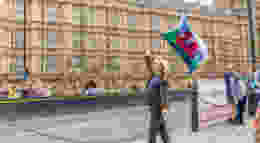

Behold the rise of the Green agenda

Bill Blain describes the emergence of support for the Green movement across Europe as an intensely significant moment. The slide in centrist parties means the Greens now hold an important slice of the vote and therefore the political agenda.

Forget Brexit, fret not about the candidates for the Tory blundership, forget all the ructions, double dealing and compromises to determine who gets what job in Brussels, lay aside your concerns about right-wing resurgence in Italy and France, and don't even be that concerned with how the next US elections are shaping up. These probably don't really matter. The immediate market threat is going to remain how deeply markets are mired in the China Blues. The immediate investment opportunity is playing these shifts.

But, something else is happening – it's happening here in Europe, and even in the US. Here in Yoorp we just saw the Greens take ten per cent of the Euro Parliamentary seats – a second in Germany. I suspect that's an intensely significant moment because of the slide in centrist parties means the Greens now hold an important slice of the vote and therefore the agenda, and the Greens are the only homogeneous political force across Yoorp. Yep. I know what you are thinking – that woman from Brighton is the prime example of why no one takes them seriously and what brings them down.

Wake up and smell the organic coffee!

Even the US is finally waking up to Green politics and the environment. While Trump is quite happy to see the environment as a resource to be mined, for the rich to get richer, and of little consequence, he's out of touch. For an update on Trump's climate denial try this from Vanity Fair. For some time now I've been following a very interesting discussion about the future of the Republican Policy. It's clear they are concerned about the future in terms of social policy, health and education, and especially the environment. They know it increasingly ticks voter concerns. When senior republicans are rejecting Trump's climate denial and calling for a "Manhattan project scale initiative" to address Climate change and remove CO2 from the atmosphere – it feels like an important moment has arrived.

This is a big moment – how to address not just a fashion to invest in Green economics, but it's now become a political and economic imperative. Forget the easy approach, buying bonds and stocks labelled "green", ESG, or "climate-friendly" – and actually seek investment opportunities in assets that do environmental good and will therefore rise in value as the era of Green investing becomes critical.

Before I start to explain how, let's digress a moment.

Trade is the big theme the market is paying attention to today. Markets are wondering how damaging and how deep will the trade spat go? How wide will it spread? Will US vs China morph into the trade and tech cold-war many foresee? China showed the rare-earth card last night – a factor that will cause permanent change to global supply chains if they play it. And if it does, what opportunities does that kick off? Lower Bond yields confirm it's a risk-off market as participants try to figure out where to position.

The obvious risks are a global recession – but how central banks can react (note I wrote can, not will), is going to be interesting. How do you stimulate a European or Japanese economy where rates are already effectively zero? How will the Fed react when inflation starts to edge up, the dollar is safe haven currency, and while Treasuries may remain the key safe haven asset – what about corporate bonds where recession, slowdown, overly expensive dollar, covenant lite and high gearing leaves investors nervous?

Maybe the right question to ask is – how did we get to this point where trade war is a genuine threat?

Just last year many economists were still predicting a rosy post Global Financial Crisis economic boomtime. As economies around the world came out of 10-years of pain, it was widely expected we'd see economic activity and corporate earnings rise to the kind of levels that would begin to justify stock market prices (which we all accepted were artificially high, distorted by QE.)

Instead, we got Populism – mass social movements rejecting the status quo.

But, I would argue most populist movements – in Europe; Greece, Spain and soon Italy, in the UK in terms of Brexit and elsewhere – have effectively already failed. They have found themselves caught in waves of indecision, undeliverability and increasingly small circles. Hence the failure of the left in Europe and swing to the right in many places, and the inability of the UK Parliament to agree a Brexit compromise.

It's the US where Populism – against all expectations – succeeded. Trump. How we giggled when he was elected, trying to imagine how such a cartoon orange ogre could ever succeed. But he is changing the world – and that's what matters in term of long-term investment decisions. He's opened a trade war – deliberately – that is changing the expectations of what the world looks like. As a result, Trump's populism, unlike elsewhere, has become truly market significant.

What if the current swing towards a Green agenda in Europe, and the rising realisation in the US that climate change and the environment as a threat is as market moving and significant as the Trump disruption? I'd argue Trump isn't that important – it's what he's done that is. A cold war with China will trigger damaging economic consequences, but ultimately play into US strengths. It will happen long after Trump has gone.

But US trade victory won't matter a damn if climate change is real, and New York is three meters deep in the newly expanded Hudson River Estuary… And climate change is happening. I believe the scientists.

I've said before the negative consequences of climate change can probably be avoided by human inventiveness and innovation. The technologies to lay off Carbon now exist. Waste treatment has become a major imperative for environmental clean-up. Tech to clean oceans of plastic will come. Renewable energy sources have been widely adopted. More is happening – but they all need to be financed… and that's a market opportunity.

I suspect the next few years will be remembered as the era where the world woke up to the environment and undid the damage…