Trump bashing hinders Brexit

Theresa May's failure to reprimand her MPs for gratuitously insulting the President of the United States is harming our alliance at a time when we need it more than ever, says Peter Bingle.

In recent days, I have felt a growing sense of anger and embarrassment as British politicians of no obvious merit such as Heidi Allen (who?) and John Bercow (why?) have gratuitously insulted the democratically elected President of the United States.

Forgive me for pointing out an obvious but nevertheless important point. In a post Brexit world, we need to work more closely than ever with our most important ally. President Trump could not have been more supportive. And what is the response of the British political class? To insult him…

I have known John Bercow long enough to never take him seriously. Nor should anybody else. Insults from Jeremy Corbyn and his cronies were to be expected. But why hasn't the PM and her Chief Whip, Gavin Williamson, imposed any degree of discipline on Tory MPs? Have the likes of Heidi Allen (who?) been called in by the Whips and reprimanded for her comments about President Trump? It would seem not…

This is not an issue about the detailed aspects of President Trump, his style, or even his policy agenda. It is simply that we should respect the office of President of the United States. Imagine how we would feel if American politicians commented on an hourly basis about our PM. We wouldn't like it!

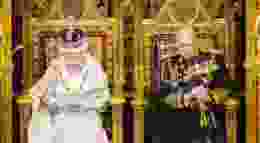

Since returning to the UK after her successful visit to the White House, the PM has shown none of the political courage of Margaret Thatcher. She has opted for the easy option and has refused to support and defend a President who extended her the hand of friendship at a critical time.

The PM and the entire political class seem to have forgotten that we need President Trump's political and economic support in the years ahead. After the torrent of personal abuse aimed at him in recent days he must be sorely tempted to tell the PM that she can stick her State visit and trade deal up where the sun doesn't shine. I for one wouldn't blame him. We need to get a serious dose of reality! We no longer have an empire …

What is it about the British political class that at a time when the British public hold them in contempt they feel able to attack a politician who received a massive political endorsement from American voters? They need to get real and quickly or President Trump will show them all to be knaves and buffoons …

I have never felt so embarrassed by British politicians. When will the PM grow a backbone?