Obama’s fitting end to a disappointing tenure

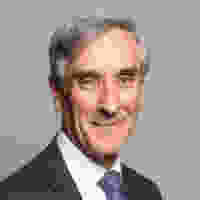

It seems fitting that Obama's lacklustre Presidency should end in the company of European leaders who, like him, have also lost touch with their electorate, says John Redwood.

When he was first elected President Obama had huge political goodwill around the world. Many wished him well and were excited by his personal story. I liked the promise of a new approach to international relations. I particularly liked his pledge to close Guantanamo Bay, a blot on the Western conscience, and his wish to disengage from Middle Eastern wars. He carried with him the hope of diplomacy, a new language about reconciling differences and trying to overcome old enmities with new approaches.

Like many I feel badly let down. He never closed Guantanamo. The war in Iraq dragged on, as did the war in Afghanistan. The President often dithered, then added to the military forces involved. He went along with intervention in Libya which removed a bad government, to replace it with a rolling civil war. He bombed some of the time in Syria, as the West sought to create a third force of moderate democrats who either did not exist or who were overwhelmed by both sides in the violent conflict. It is difficult to say the Middle East is a better place today than eight years ago, though Americans have shed much blood and spent much treasure on trying to remodel several countries.

For me the worst moment of his Presidency was when he dared to come to the UK to back the Remain campaign. It was a catastrophic error for the Leader of the Free world to involve himself in a referendum in a friendly country on the wrong side, arguing with those who wanted to argue the British/EU colonial government case rather than the case of the Independence seeking Americans/UK citizens. He communicated a sense of a man who did not particularly like our country. His eviction of Churchill's bust from the Oval Office was in itself unimportant. I understand his wish to surround himself with his own choice of greats and mentors. It did however, speak eloquently to us that he did not consider the shared crusade to rid Europe of fascism in the 1940s as an important story worthy of recollection close to his desk.

He started his Presidency with the banking crisis in full flow. The US responded more vigorously and more successfully to it than Japan had done to its crisis in the late 1980s, or the Euro area did in 2008-16. During his term the US economy has experienced a sustained but moderate recovery from the collapse it felt in the early days of his tenure. He spent much of his political capital in pushing through Obamacare, which badly divided his nation and led to the collapse of the Democrat vote in subsequent elections. In his later months in office he has seemed strangely detached from the job, surviving in it by touring the world and espousing all the establishment causes he can find.

It is perhaps a fitting end to his tenure that he spends time in Europe with a series of continental politicians that have themselves lost touch with their voters, to make common cause to be tougher against Russia. This is one farewell tour where I will not be buying the soundtrack. Whatever happened to the hopes of a more peaceful world?

John Redwood is a former Conservative MP for Wokingham and a former Secretary of State for Wales. For more on UK tech and innovation policy, read Sean Kohli on why Britain must back its founders to win the AI race.