France pulled back from the brink

Bill Blain discusses the implications of the French Presidential result for France, Europe and the United Kingdom.

The best thing about the French Election is I've just won a case of very fine French wine on the result!

The papers and financial blogosphere are full of positivity – France is fixed, therefore the Euro is safe and it's all great news. Put your buying boots on. And on the back of Friday's very strong US numbers… don't worry that bonds continue to rally in the face of a likely Fed hike.

Please, the only thing good about the French vote is the least bad candidate won.

I question the grand expressions of upside the market is calling for. France has dodged a bullet, perhaps, but they haven't solved the crisis – which boils to down to being the wrong economy using the wrong currency and absolutely no control of monetary or fiscal policy to fix it.

Macron has a head full of supply side policy clichés about sorting the labour market, and some catchy soundbites on Franco-German European hegemony – including the sacrifice of a fraction of the bloated state payroll. For all the hype, he's a compromise of compromise candidates.

Let's not forget that fully 12% of the votes were spoilt – meaning a significant minority of Frenchmen made a conscious choice that neither candidate was any good!

I'll make a grand prediction: Macron will prove a disappointment. His lack of power base from which to actually effect long term change across France means we'll get one or other of the Le Pens in five years' time.

Although he will no doubt trade on his youth and popularity – don't be surprised if the lustre quickly fades. Several blogs say he'll quickly build a coalition of the willing. I doubt it. He's going to struggle to form any kind of working government in the face of the established parties, and hostility from right and left.

There is also the likelihood the electorate will come to realise the gifted young game-changer is as establishment as they come. Don't forget he is the protégé of Jacques Attali – those of us of a certain vintage will remember Attali as the archetypal enarch – squandering billions on titivating the Glistening Bank (The EBRD) with marble lifts and ego-building offices rather than lending. Macron's paid up membership of the discredited French upper class is something a better organised Front Nationale will play to in coming years.

On the upside, the numbers are moving in Macron's direction. The state isn't in the same perilous debt position pre-ECB intervention. A wee bit inflation will massage the numbers nicely. There are no immediate risks on the horizon. Unemployment is trending down (slowly), and is likely to boost his popularity. Merkel looks a shoe in for the German Election (very strong showing at the weekend in Danish Germany).

But, but and but again.

When Europe looks calm and sorted, it's not. Nothing is fixed. For all the happy posts this morning about Euro strength, which stocks to buy based on the French recovery, and the rest… I doubt it.

Although there is apparently nothing to worry about in Euroland anymore – we've still got the festering pustule that is Italy, episode 47 of the Greek Crisis on our doorsteps, and the who knows what coming from the Brexit negotiations. Europe will continue to amuse, fascinate and frustrate.

I don't normally spend my Sundays watching the TV wallpaper paste that passes as "political comment" but as I supped my coffee, one soundbite caught my ear: "the aim of Europe is to ensure the economic collapse of the UK to make clear leaving the EU is never an option."

Oh dear….

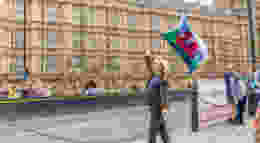

Is there a danger the now pointless UKIP decides to establish some convoluted relevance as the force of anti-Europeanism? Sure enough, someone later suggested we should mount a European boycott. If we stop buying French plonk, German cars, Spanish holidays, etc., then that'll teach 'em.

It so happens an American chum of mine was in Yoorp over the weekend and he popped down for dinner last night. As he is an economist of some renown, and a former Scotsman before he went all Yankee on us, I asked his opinion on Brexit and what America thinks. He was succinct: "We don't give a fig. As long as you all play nice and don't break the global economy, meaning we'll have to bail it out, we really don't care about Europe and the UK." Nice, but to the point.

A trade war with Europe and the nihilistic post-UKIP politics of aggression would be a very bad idea. If I can't get good European wine, it will inevitably mean drinking more Argentine Malbec. Not a bad wine, but it's impossible to function properly afterward!